Contact: (239) 466-1131 • (800) 780-1131

Introducing

An UNPARALLELED FUTURE is in VIEW

Discover the Newest Residences at Shell Point

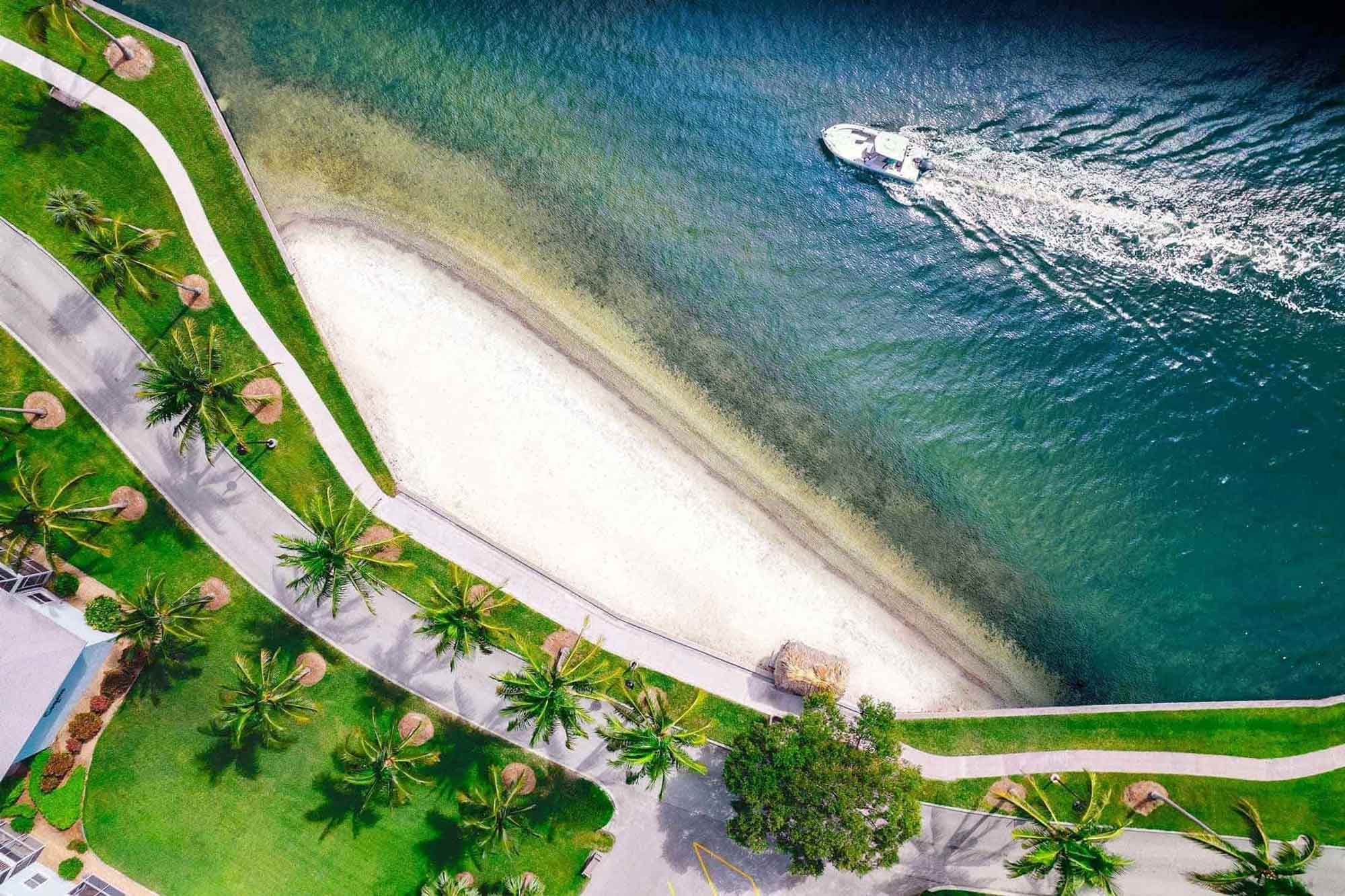

Located in one of the most sought-after neighborhoods, Vista Cay offers waterfront residences with sunrise views of the Caloosahatchee River and sunset vistas over Sanibel Island.

Why wait to enjoy world-class amenities and the peace-of-mind that lifecare provides? We can always find a place for you to call home Ask about our move-in ready residences.

Shell Point’s 700 acres include distinctive neighborhoods, a wide array of home styles, resort amenities, and convenient services — all situated in a tropical setting along the Caloosahatchee River in Fort Myers, Florida.

At Shell Point, you’ll enjoy a comfortable, well maintained residence, and a full range of wellness, recreational, social and spiritual programs staffed by dedicated professionals. Plus, you’ll have the assurance of lifecare, including assisted living and skilled nursing care and memory care.

Offering a variety of contract options, including refundable options, Shell Point can help take the worry out of retirement while meeting your budget requirements. When you retire at Shell Point you have the comfort of knowing that your needs will be taken care of, both now and in the years to come.

Since 1968, Shell Point has been providing residents with a tropical, resort‑like lifestyle, while at the same time, ensuring they will receive healthcare when needed.

Shell Point’s healthcare services include the convenience of two medical centers, plus a staff of on‑site physicians and a number of specialty physicians, as well as assisted living and skilled nursing, memory care, hospice care, physical therapy and rehabilitation, home care, behavioral health and a full‑service pharmacy that will deliver medication right to your door.

With so many options… you are bound to find the perfect fit.

Explore the neighborhoods below to see where you may next call home.

Water wonderland - surrounded by water, The Island is the jewel in the crown of Shell Point.

Exclusive and pristine villas neatly tucked away between the fairways.

Quintessential Florida luxury living with views to match.

At the heart of Shell Point, luxury midrise living with adjoining tennis and pickleball courts.

Luxury living in the middle of Shell Point's 18-hole championship golf course.

As unique and individual as you are! Set sail from your own personal launch at the end of your back yard.

The area around Shell Point is home to tropical wildlife, which makes life exciting for nature lovers. Immediately to the west are the Gulf of Mexico and the famed barrier islands of Sanibel and Captiva, internationally known for their white sand beaches, turquoise waters and the abundance of exotic shells that wash up on their shores.

13921 Shell Point Plaza

Fort Myers, FL 33908

(239) 441-2054 • (833) 718-8594

"*" indicates required fields